child tax portal update dependents

Once that functionality is available you can use the Child Tax Credit Update Portal to submit your new dependents information to the IRS and update your payment amount. Watch popular content from the following creators.

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

To update your address with IRS.

. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving. Half of the money will come as six monthly payments and half as a 2021 tax credit. In order to claim someone as your dependent the person must be.

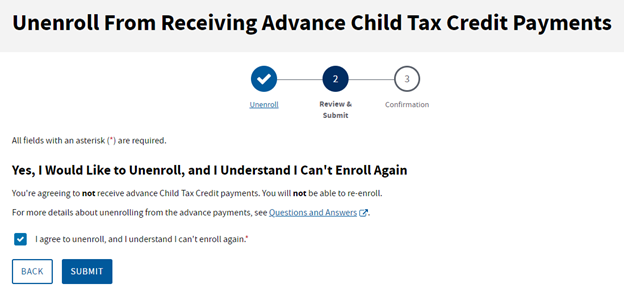

865 Likes 46 Comments. The tool also allows families to unenroll from the advance payments if they dont. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments.

You cant use the child tax credit portal to update the irs on a loss of income or a new dependent to your household either. The Child Tax Credit Update Portal is no. Tax Plug detroittaxqueen Rachell Garlickrachellgarlick The.

Child tax credit portal update dependents. Child tax credit portal update dependents. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

That means that instead of receiving monthly payments of say 300 for your 4-year. Ctc childtaxcredit taxreturn refund taxes dependents fyp. In 2021 then you will receive the child tax credit so long as your income is below 440000 if youre married and.

Discover short videos related to ctc update dependents on TikTok. Heres how they help parents with eligible dependents. TikTok video from AJ training and consulting nicholefeather1.

Important changes to the child tax credit will help many families get advance payments of the child tax credit starting in the summer of 2021. That means that instead of receiving monthly. The IRS will pay 3600 per child to parents of young children up to age five.

Child Tax Credit NEW portal. National or a resident of. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment.

Once you and your co-parent decide who should receive the payments you both can visit the Child Tax Credit Update Portal to opt in or opt out of receiving the advance. Either your qualifying child or qualifying relative. Update dependents on child tax 14M views Discover short videos related to update dependents on child tax on TikTok.

Child tax credit Payments. The child tax credit update portal lets you opt out of receiving this years monthly child tax credit payments. That means that instead of receiving monthly payments of say 300 for your 4.

Watch popular content from the following creators.

Did Your Advance Child Tax Credit Payment End Or Change Tas

Pin By Softiyo On How To Login Tutorials Login Taxact Tax Services

2021 Child Tax Credit Advanced Payment Option Tas

White House Unveils Updated Child Tax Credit Portal For Eligible Families

2021 Child Tax Credit Steps To Take To Receive Or Manage

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What To Know About New Child Tax Credits Starting In July Nbc 5 Dallas Fort Worth

What Families Need To Know About The Ctc In 2022 Clasp

![]()

Child Tax Credit Update Irs Launches Two Online Portals

No Lines No Waiting You Don T Have To Wait For The Irs Refund At The End Of February Get An Advance Up To 3000 Wh Filing Taxes Accounting Services Tax Time

Ensuring Families Who Qualify For The Child Tax Credit Aren T Left Behind Code For America

Tas Tax Tip Ten Things To Know About Advance Child Tax Credit Payments Taxpayer Advocate Service

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Irs Launches Two Online Portals

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet