does doordash report income to irs

Posted by 27 days ago. DoorDash drivers are not full-time employees of the company which means that DoorDash does not withhold taxes from your income.

Doordash 1099 Forms How Dasher Income Works 2022

Once you receive the 1099 form and file the taxes you need to report the exact figure as the overall income to the IRS.

. Does DoorDash issue a 1099. Does DoorDash issue a 1099. Does DoorDash report income to State or just IRS.

According to the IRS independent contractors need to report and file their own taxes. DoorDash will send you a 1099 form at. How does Instacart report wages.

DoorDash can be used as proof of income. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC. Yes all income is considered taxable by the IRS.

In this way Does DoorDash. It also includes your income. Since dashers are treated as business owners and employees they have taxes.

You should report your income immediately if. DoorDash delivery drivers are self-employed with a contract through DoorDash. Dashers are not required to report their income at the end of the year.

DoorDash drivers are not full-time employees of the company which means that DoorDash does not withhold taxes from your income. Ago Tax evasion is illegal. Federal income taxes apply to Doordash tips unless their total amounts are below 20.

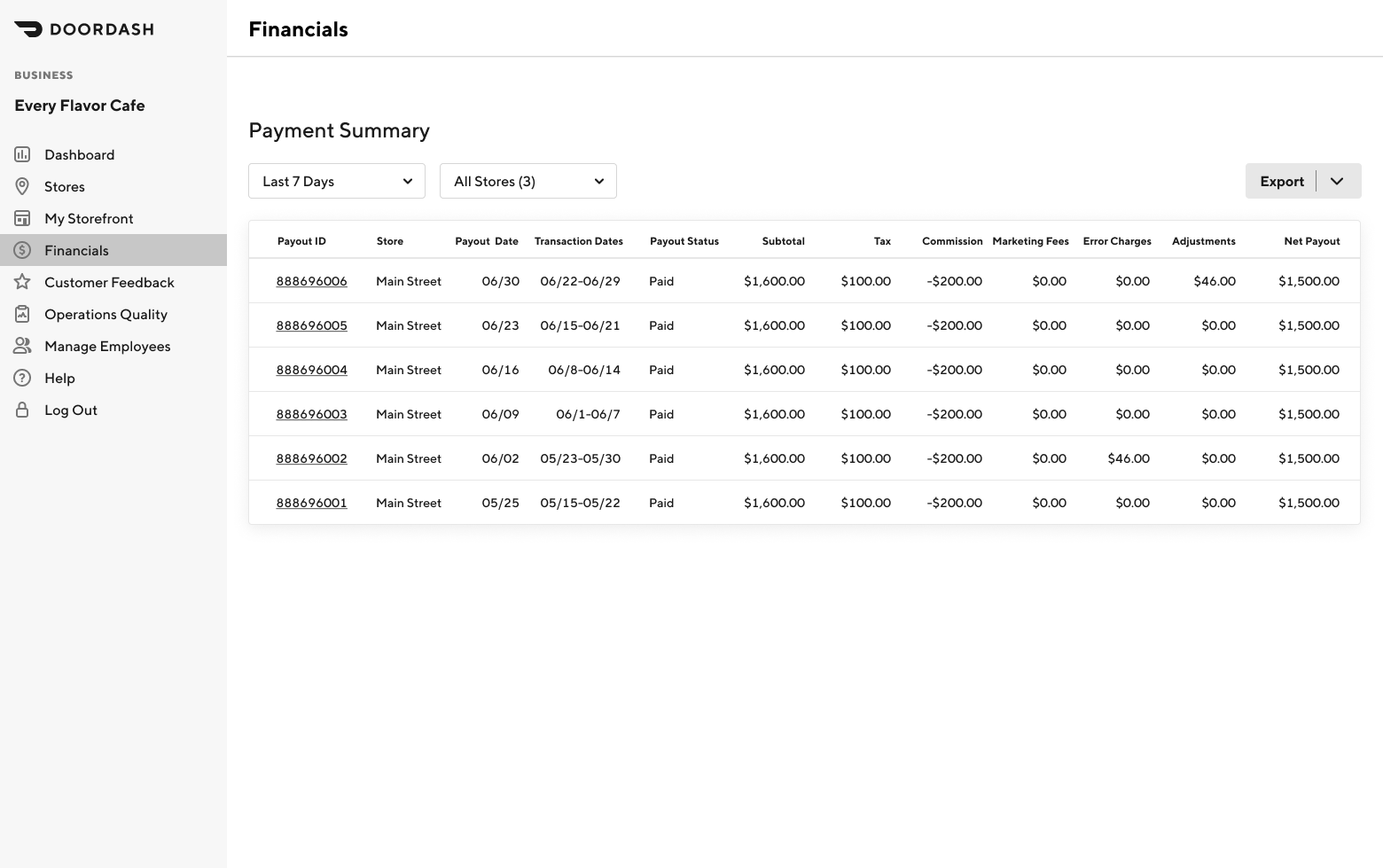

Here you will add up how much money you received for your delivery work. Self-employed means that the company does not withhold federal or state income tax and they do not. Do I need to report DoorDash income if it is less than 600.

Your cash tips are not included in the information on the 1099-NEC you receive from. Doordash considers delivery drivers to be independent contractors. Does DoorDash report income to State or just IRS.

Dashers pay 153 self-employment tax on profit. This is a flat rate for gig work so youll pay the same. Bigblard 2 yr.

Dashers are self-employed so they will pay the 153 self-employment tax on their profit. The forms are filed with the. The 600 threshold is only for mandating a company send a 1099 form to an.

What you just said amounts. Doordash does not provide. Yes - Cash and non-cash tips are both taxed by the IRS.

This includes 153 in self-employment taxes for Social Security and Medicare. Tax avoidance is every Americans patriotic duty. You do have the.

Expect to pay at least a 25 tax rate on your DoorDash income. How Do I Apply For Unemployment Benefits With. DoorDash usually sends a 1099 to its drivers to keep track of their earnings to the IRS.

January 31 -- Send 1099 form to recipients. DoorDash does not take out withholding tax for you. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms.

How Much Do You Pay In Taxes Doordash Reddit Lifescienceglobal Com

You Will Be Suspended Uh Huh Yeah Right R Doordash

Taxing The Gig Economy Congress Made An Improvement But More Reforms Are Needed

Do I Owe Taxes Working For Doordash Net Pay Advance

Prepare For Tax Season With These Restaurant Tax Tips

How To Become A Doordash Driver Dasher Pay What To Expect Review

How To Get Your 1099 Tax Form From Doordash

Reporting 1099 Delivery Driver Income On Your Taxes In 2022

Doordash Taxes Does Doordash Take Out Taxes How They Work

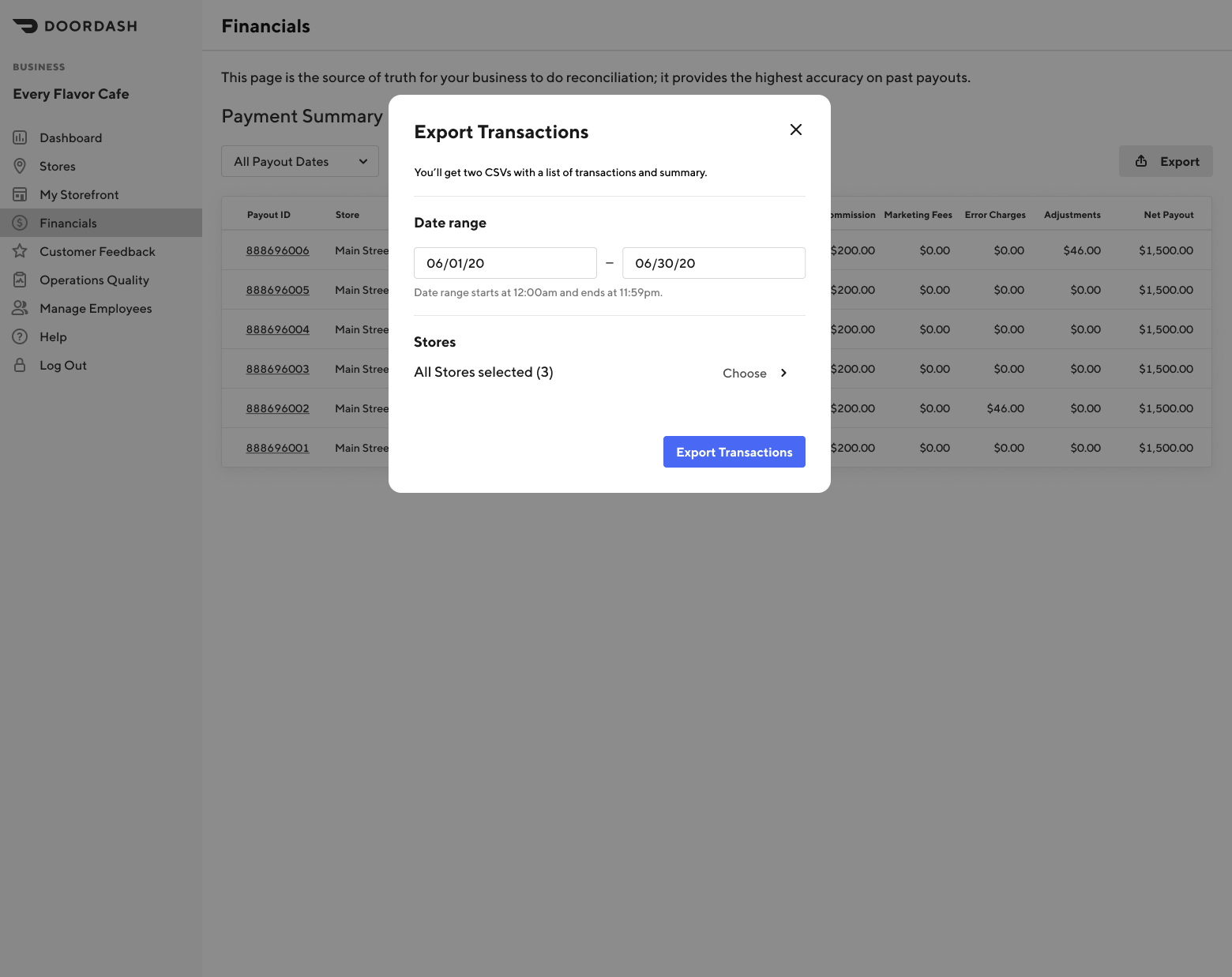

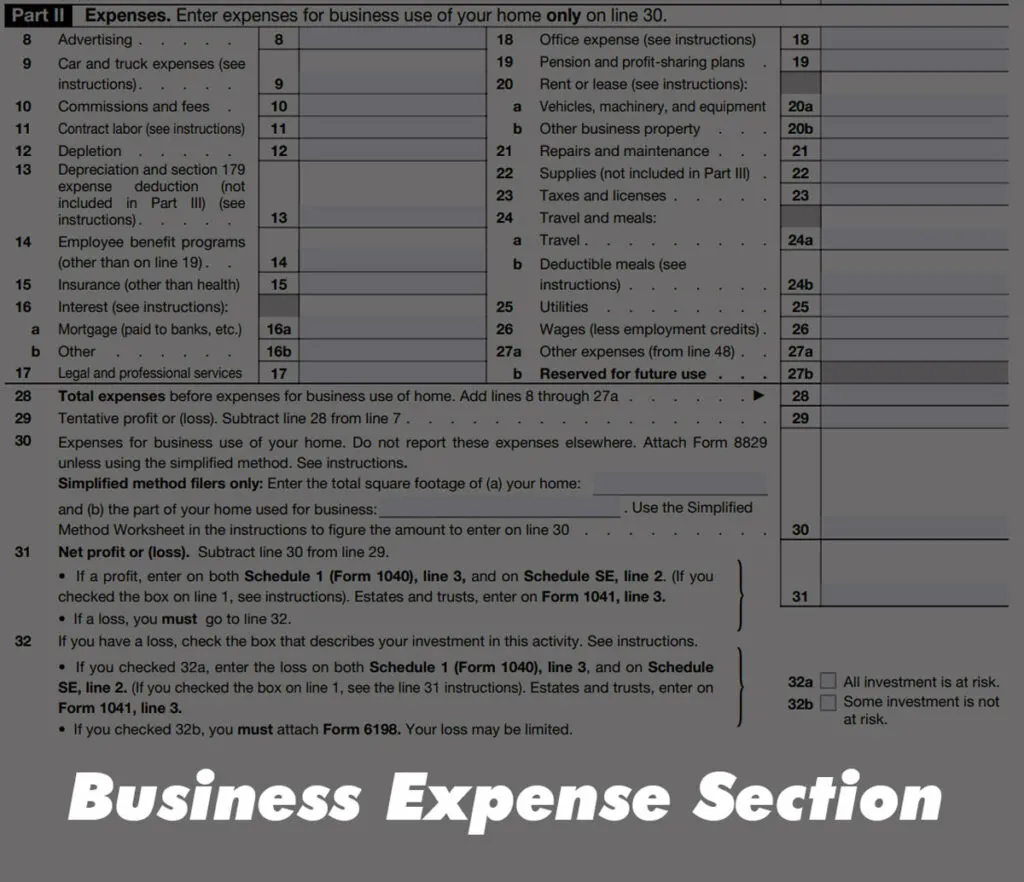

How To Fill Out Schedule C For Doordash Independent Contractors

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Filing Doordash Tax Forms Income Taxes For Dashers 2022

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Prepare For Tax Season With These Restaurant Tax Tips

Doordash 1099 Forms How Dasher Income Works 2022

What Is An Irs Schedule C Form